This presentation delves into the dynamics of South American ports, presenting a comprehensive overview of their operational scale and connectivity.

It is useful to follow up on the volumes recently handled by the South American ports in order to have a perspective of the strength of each port and the changes observed between them.

By examining the total volumes in terms of TEUs and connectivity indices for the full year 2023 and beyond, we aim to provide a broader perspective on how these container ports integrate into the global shipping trade.

With regions like Panama, Brazil, Mexico, and Colombia at the forefront, South America is increasingly pivotal in the international shipping landscape.

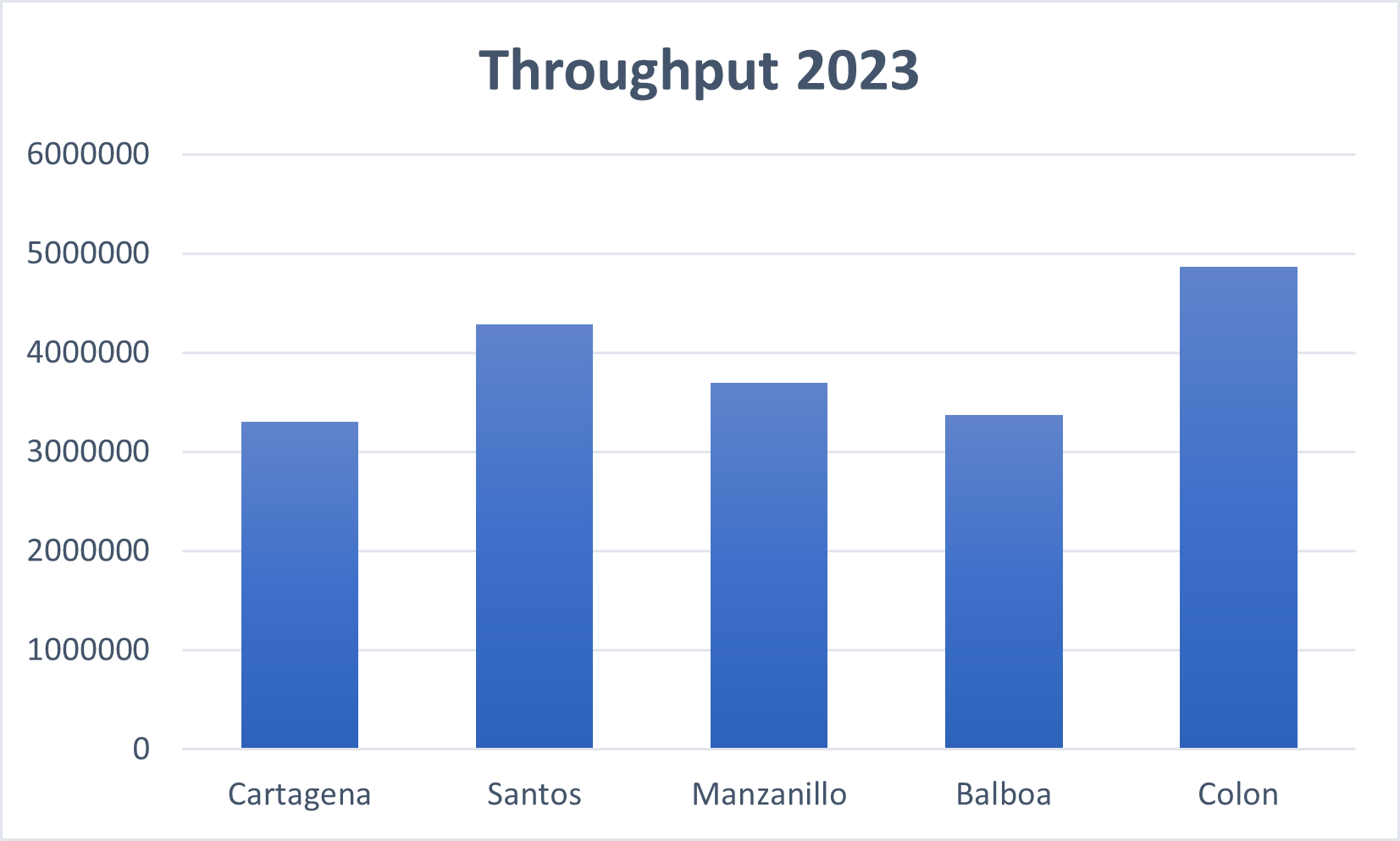

As we can see in the following graph, the busiest container ports in South America in 2023 were the ports of Colon, Santos, Manzanillo, Cartagena and Balboa.

The 2023 throughput data for key Latin American ports showcases a fiercely competitive landscape, with significant volumes handled across the region.

Panama’s Colon area leads the charge, highlighting its dominant position in the Caribbean with the highest throughput, followed closely by Brazil’s port of Santos, which serves as a critical nexus for South America’s trade.

Meanwhile, the Pacific coast’s Balboa port maintains a strategic importance due to its connectivity through the Panama Canal.

Cartagena in Colombia and Manzanillo in Mexico also play substantial roles but handle slightly lower volumes compared to their counterparts. However, their proximity in volumes reflects the dynamic and competitive nature of maritime trade between them, as both countries are being considered emerging economies.

This competitive environment not only drives improvements in port infrastructure and services but also underscores the integration of these ports into global trade networks.

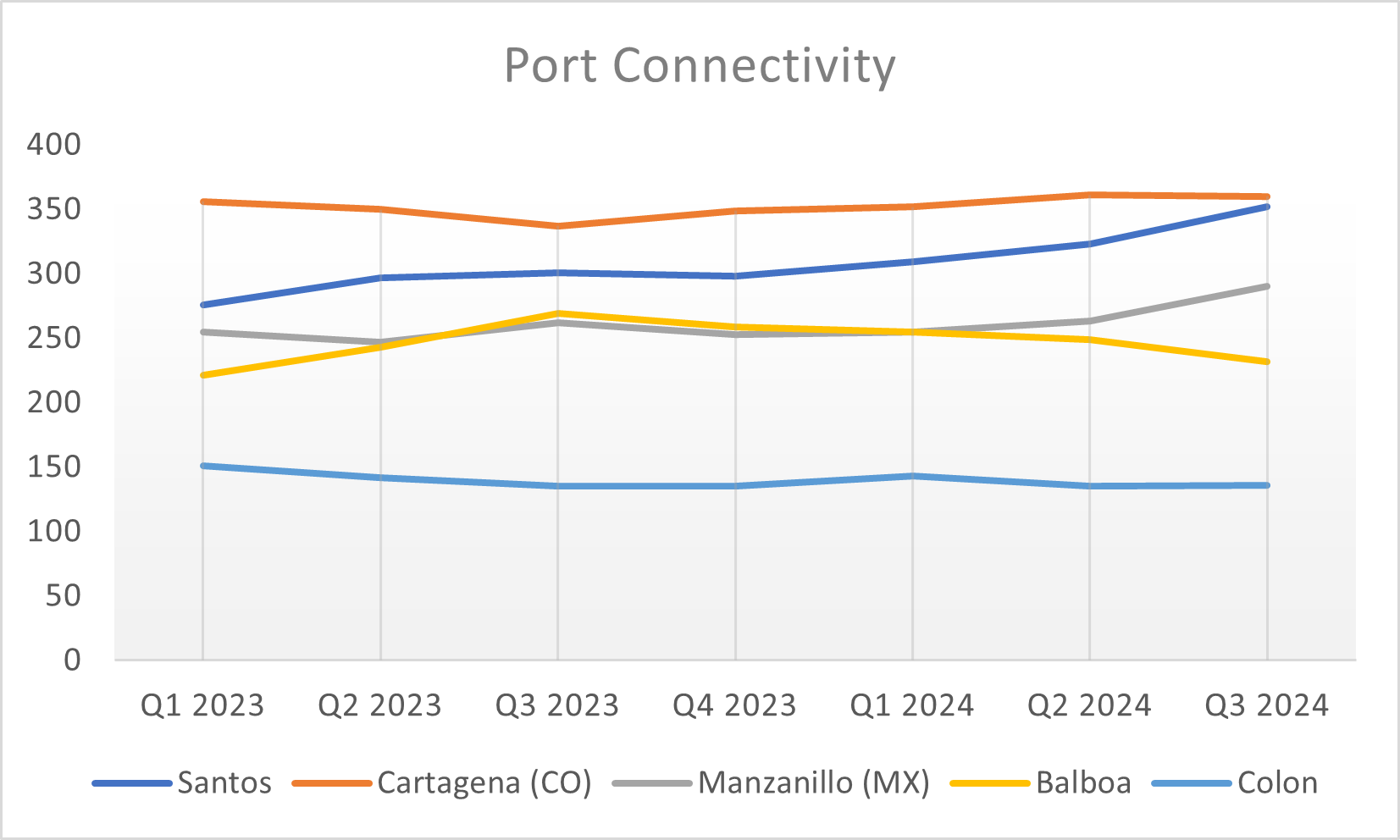

The comparative connectivity table also reveals an interesting yet competitive view of the South American ports.

Cartagena leads consistently with the highest connectivity index, which even appears to slightly increase towards Q3 2024, underlining its strategic importance as a transshipment hub in the Caribbean. However, the port of Santos demonstrated a significant increase in the same quarter, having approached Cartagena’s levels.

Manzanillo port also has a growing trend after the third quarter of 2024, highlighting its integration into global maritime trade and underscoring Mexico’s emerging trend as a trade hub.

The ports of Panama, though high in terms of TEU volumes, face either a decreasing or a stabilized but low connectivity index, possibly attributed to the Panama Canal challenges due to the prolonged drought that began in early 2023 and has not let up.

Source: Container News