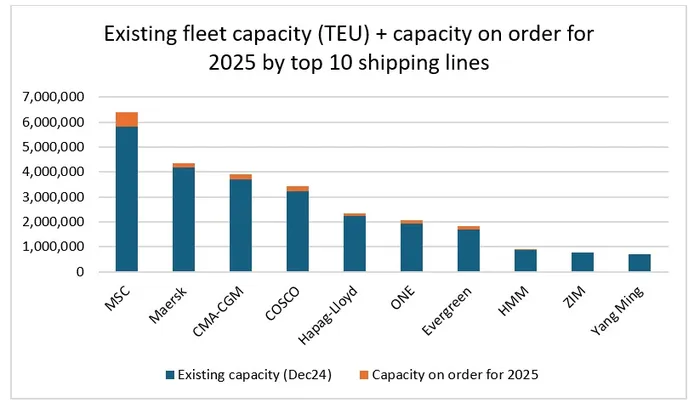

Newbuilding deliveries in 2025 will double the capacity overhang even following the absorption of capacity following the Red Sea diversions, according to shipbroker Braemar.

In its latest market report Braemar said that it had expected 2024 overcapacity to reach 12-13% in this year, up from around 9% in 2023, but the Red Sea diversions quickly put paid to that projection.

“In 2024 overcapacity was significantly suppressed, despite significant fleet growth. We estimate vessel overcapacity in 2024 will be in the region 3-4%,” said the Braemar report, written by researcher Jonathan Roach, “Despite underlying overcapacity, the high level of uncertainty surrounding Cape of Good Hope transits has understandably enticed a surge in newbuilding investment in 2024,” he added.

In 2025 the deliveries of new vessels will again raise the capacity oversupply, said Braemar, “even allowing for Red Sea avoidance, oversupply is expected to increase from 3-4% in 2024 to 7-8% in 2025,” said the broker.

Estimates of the the actual amount of capacity set to be delivered varies, but to Dynamar analyst Darron Wadey puts the number at around 220 vessels are scheduled to be delivered totalling around 1.9 million teu, representing a vessel growth rate of 3%, but a capacity increase, without scrapping, of 6%.

“It is unlikely that demand will grow at anything like the same rate as the 6% capacity,” said Wadey.

Consultancy MDS Transmodal has calculated the current fleet stands at 29,483,380 teu, with some 1,817,706 teu to be delivered next year, however, MDS also calculated that over 3 million teu will be 20 years old or over by the end of 2024.

According to Braemar 100 vessels scheduled for delivery are in the neo-Panamax sector, 14,000-18,000 teu, while a further 75 ships between 7,500 and 10,000 teu make up the bulk of the expected deliveries. A further 44 mega-ships, in excess of 18,000 teu are on order, with 31 ships in the 10,000-14,000 teu sector.

Flexibility appears to be the major driving force in the ships arriving from shipyards next year, perhaps reflecting the uncertainty in the market.

Wadey, also highlights that uncertainty with the supply and demand equation has “luckily kept in check” by the diversion of vessels around the African Cape, rather than transiting the Red Sea and Suez.

“Should that situation resolve itself, what are we to do with all those ships suddenly surplus to requirements that are already on the water?” Asks Wadey, “And then, what are we to do with all those ships that are scheduled to come? Organic demand will come nowhere near enough to fill the freed up and new capacity.”

Source: Seatrade Maritime