Understanding the U.S. Reciprocal Tariff Formula: What It Means for Global Trade

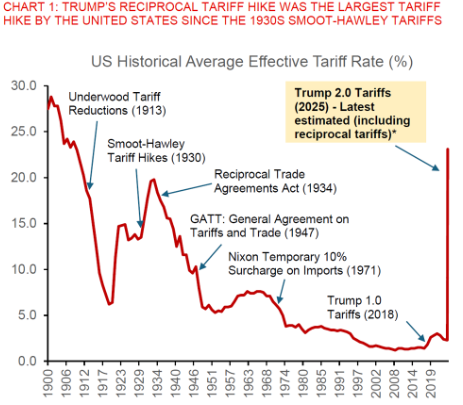

In a bold recalibration of its trade policy, the United States has introduced a formula-driven approach to tariffs aimed at reducing long-standing trade imbalances with key partners. Known as the reciprocal tariff, this method targets countries with substantial export surpluses to the U.S., signaling a new era of trade correction grounded in measurable economic data.

At its core, this policy is a strategic attempt to counter what the U.S. deems unfair trade practices — where foreign countries enjoy free access to the U.S. market while offering limited reciprocity in return. This shift marks a departure from conventional blanket tariffs toward a formula that calculates duties based on trade deficits.

The Core Formula: How the U.S. Calculates Reciprocal Tariffs

The central equation behind this policy is straightforward but impactful:

Reciprocal Tariff (%) ≈ 1/2 × (U.S. Trade Deficit / That Country’s Exports to the U.S.)

This means that the greater the trade imbalance (i.e., when a country exports far more to the U.S. than it imports), the higher the tariff rate it may face. By design, the policy only taxes about half of the imbalance — a number that is still significant, especially for export-reliant economies.

Case-by-Case Breakdown: Real-World Tariff Rates

Let’s examine how this formula plays out with actual data from 2024 (Source: U.S. Census Bureau, 2024):

| Country | Exports to U.S. | U.S. Exports to Country | Trade Deficit | Deficit Ratio | Approx. Tariff |

| Vietnam | $136.6B | $13.1B | $123.5B | 90% | 45% |

| China | $418B | $139B | $279B | 67% | 34% |

| Indonesia | $28B | $10.1B | $17.9B | 64% | 32% |

| Cambodia | $12B | $0.3B | $11.7B | 97.5% | 49% |

| Thailand | $52B | $17B | $35B | 67% | 33% |

| Philippines | $17B | $8.5B | $8.5B | 50% | 25% |

These numbers show how drastically different countries could be affected. Vietnam, Cambodia, and China — with significant trade surpluses — are facing the highest proposed tariffs. Even smaller economies like the Philippines, despite a lower volume of trade, aren’t exempt if the export-import ratio is too lopsided.

Why the Policy Exists: Leveling the Playing Field or Economic Retaliation?

From the U.S. perspective, this tariff structure is not merely economic — it’s ideological. The argument is that open access to the U.S. market should be matched by similar openness from trading partners.

Many developing economies benefit from low or zero tariffs under preferential systems like the Generalized System of Preferences (GSP). However, those same countries often maintain non-tariff barriers, subsidies, or high import taxes on American goods — creating an uneven playing field. The reciprocal tariff is the U.S. response to that perceived imbalance.

Proponents say it provides transparency and fairness. Critics, however, argue it oversimplifies complex economic relationships. Trade deficits, they contend, are not always due to protectionism but are often influenced by:

- Exchange rate differences

- Varying consumer demand

- Structural production costs

- Global supply chain dynamics

Industry and International Reaction: Who Gains, Who Loses?

Winners:

- U.S. manufacturers: Especially in sectors like textiles, steel, and electronics, where foreign competition has undercut domestic pricing.

- Export-focused states: Midwestern and Rust Belt states may benefit from increased demand for U.S. goods.

- U.S. trade negotiators: With a numeric formula in hand, they gain leverage in bilateral talks.

Losers:

- Foreign exporters: Countries with large surpluses may face margin erosion or lost market access.

- U.S. importers and retailers: Especially those relying on low-cost goods from Southeast Asia or China. Higher tariffs will mean higher costs.

- Consumers: Expect higher prices in key segments like electronics, furniture, and apparel.

Concerns Over Policy Accuracy

Some experts challenge the validity of the formula itself. A 2024 study by the American Enterprise Institute (AEI) warned that the reciprocal tariff model exaggerates the real trade deficit by focusing on gross exports, not value-added trade. Many U.S.-bound exports from countries like Vietnam or China include American components or intellectual property. This makes the net imbalance less severe than the gross figures suggest.

Additionally, the model does not factor in services — an area where the U.S. typically runs surpluses. For instance, while China might dominate in goods, the U.S. exports billions in education, tech services, and finance.

Diplomatic Fallout and Legal Hurdles

Countries affected by the policy are unlikely to accept these tariffs passively. Vietnam has already expressed intent to revisit trade terms through diplomatic channels. China has threatened countermeasures and hinted at WTO involvement.

From a legal standpoint, the unilateral nature of these tariffs — especially if applied without formal negotiation or a WTO-sanctioned dispute process — risks violating World Trade Organization (WTO) norms. This could lead to retaliatory tariffs and a weakening of global trade governance.

Strategic Implications: Not Just Numbers on a Spreadsheet

While the formula is mathematical, the message is political. The U.S. is signaling a shift toward “calculated reciprocity” — using data-driven tools to enforce what it views as trade fairness.

What This Means for Global Trade:

- Short-term disruption: Re-routing of supply chains, rising prices, and uncertain trade negotiations.

- Long-term realignment: Countries may seek to increase U.S. imports to avoid punitive tariffs, improving bilateral balances.

- Pressure to diversify: Companies may shift sourcing to nations with smaller deficits or invest in domestic production.

Conclusion: Navigating the Age of Reciprocal Tariffs

The reciprocal tariff is more than a formula — it’s a paradigm shift. By tying trade policy to measurable deficits, the U.S. has introduced a tool that is as controversial as it is transparent.

Whether it succeeds in restoring trade balance or ignites further disputes will depend on how it is implemented — and how other countries respond. For businesses, the message is clear: understand your supply chains, track your country’s trade data, and prepare for a world where imbalances come with a price tag.

Learn more: Vietnam – United States Trade Reaches 11.1 Billion USD