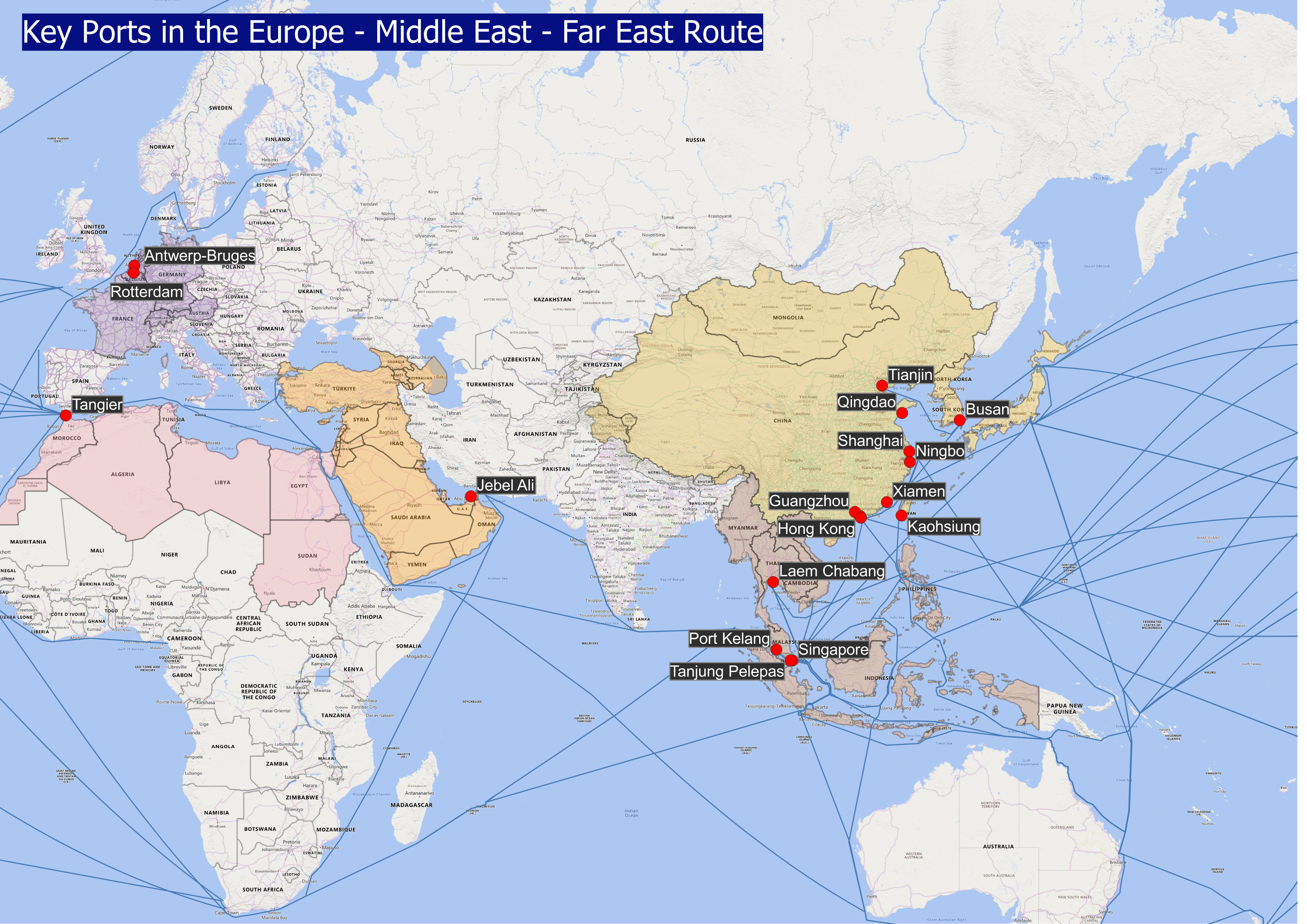

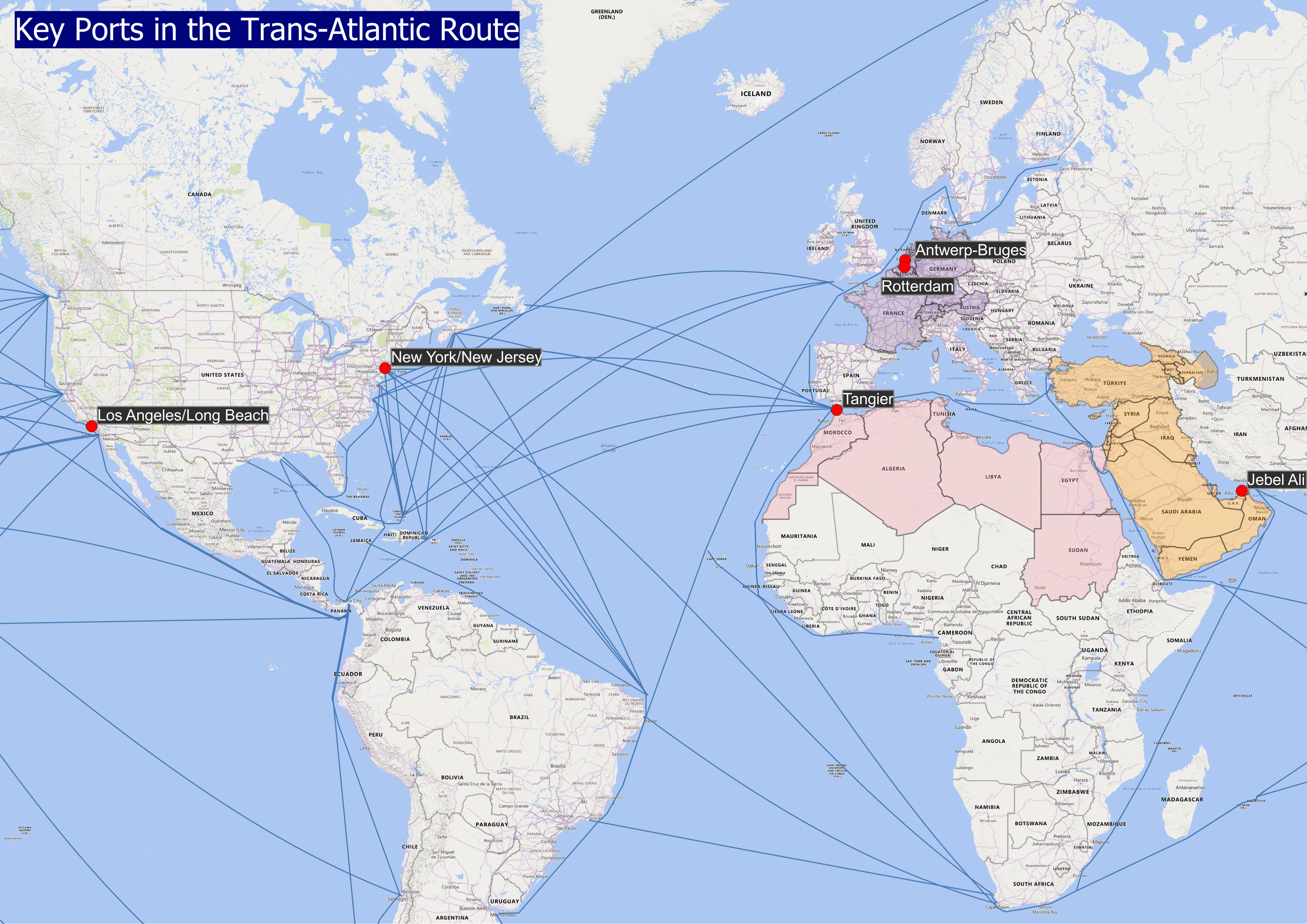

The global shipping industry has observed diverse trends among leading container ports worldwide, reflecting significant changes in connectivity and cargo volumes that influence the competitive landscape across the Far East, Middle East and Trans-Atlantic.

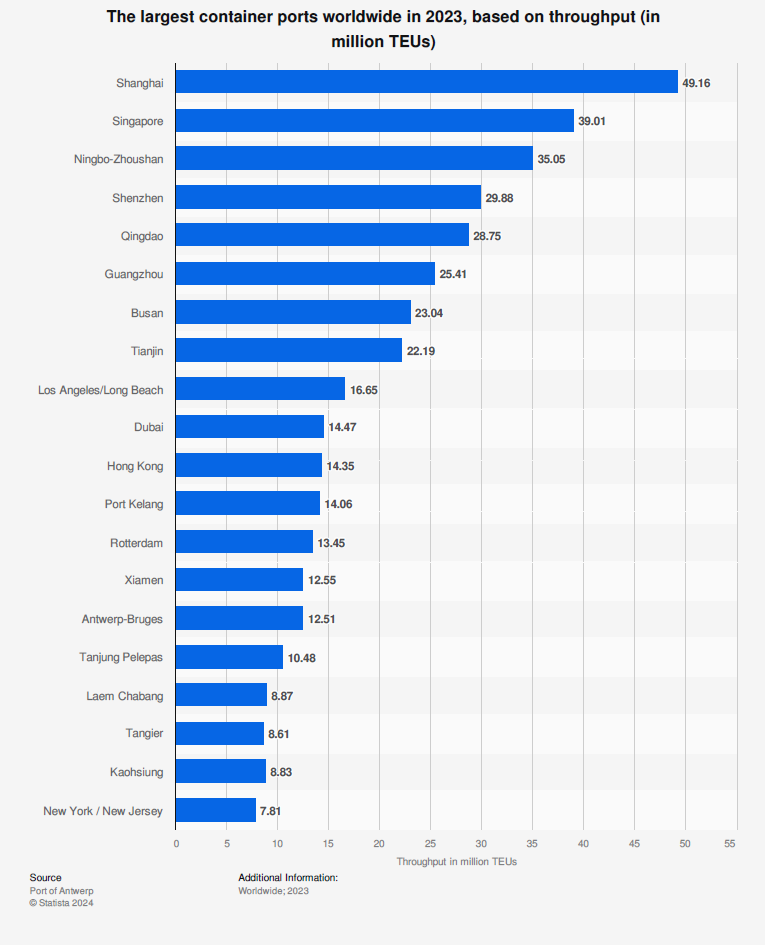

The Far East continues to spearhead global container shipping, with major ports like Shanghai, Singapore, Ningbo, and Busan at the forefront. Shanghai led globally with a record 49.16 million TEUs in 2023, closely followed by Singapore with 39.01 million TEUs. Between Q1 2023 and Q3 2024, connectivity in the Far East rose by 4.57%, solidifying its position as a key shipping region.

Additionally, the Middle East, with pivotal ports like Jebel Ali and Tangier, experienced a 2.75% increase in connectivity from Q1 2023 to Q3 2024, highlighting its strategic role as a nexus for East-West trade.

The region’s connectivity growth is part of broader efforts to diversify economies and enhance logistics infrastructures, establishing it as a crucial hub for transshipment and international trade. However, it still remains behind the Far East in terms of overall connectivity and cargo volumes.

While the Far East demonstrates robust throughput and connectivity, the Middle East is leveraging its strategic location to enhance its market position, albeit at a more moderate pace.

Meanwhile, critical ports in the Trans-Atlantic route, linking North American and European markets, saw a marginal reduction in connectivity, with an average drop of 0.63% during the same period. Despite this, the Trans-Atlantic corridor remains a pivotal axis for containerized trade.

These trends indicate a shift in global maritime trade towards Southeast Asia, with the Middle East serving as a critical transshipment hub that bridges Europe and Asia amid broader economic diversification efforts by Arab states.

Source: Container News