On April 17, 2025, the Trump administration introduced a groundbreaking maritime policy that is set to reshape global shipping dynamics. The new regulation imposes port fees on Chinese-built ships docking at U.S. ports, marking a significant effort to challenge China’s dominance in the global shipbuilding industry and revive domestic manufacturing.

1. Background and Policy Motivation

The policy follows a comprehensive investigation conducted by the Office of the United States Trade Representative (USTR). Initiated under the Biden administration, the investigation concluded that China’s maritime practices are unreasonable and discriminatory, harming U.S. commerce and weakening its industrial base.

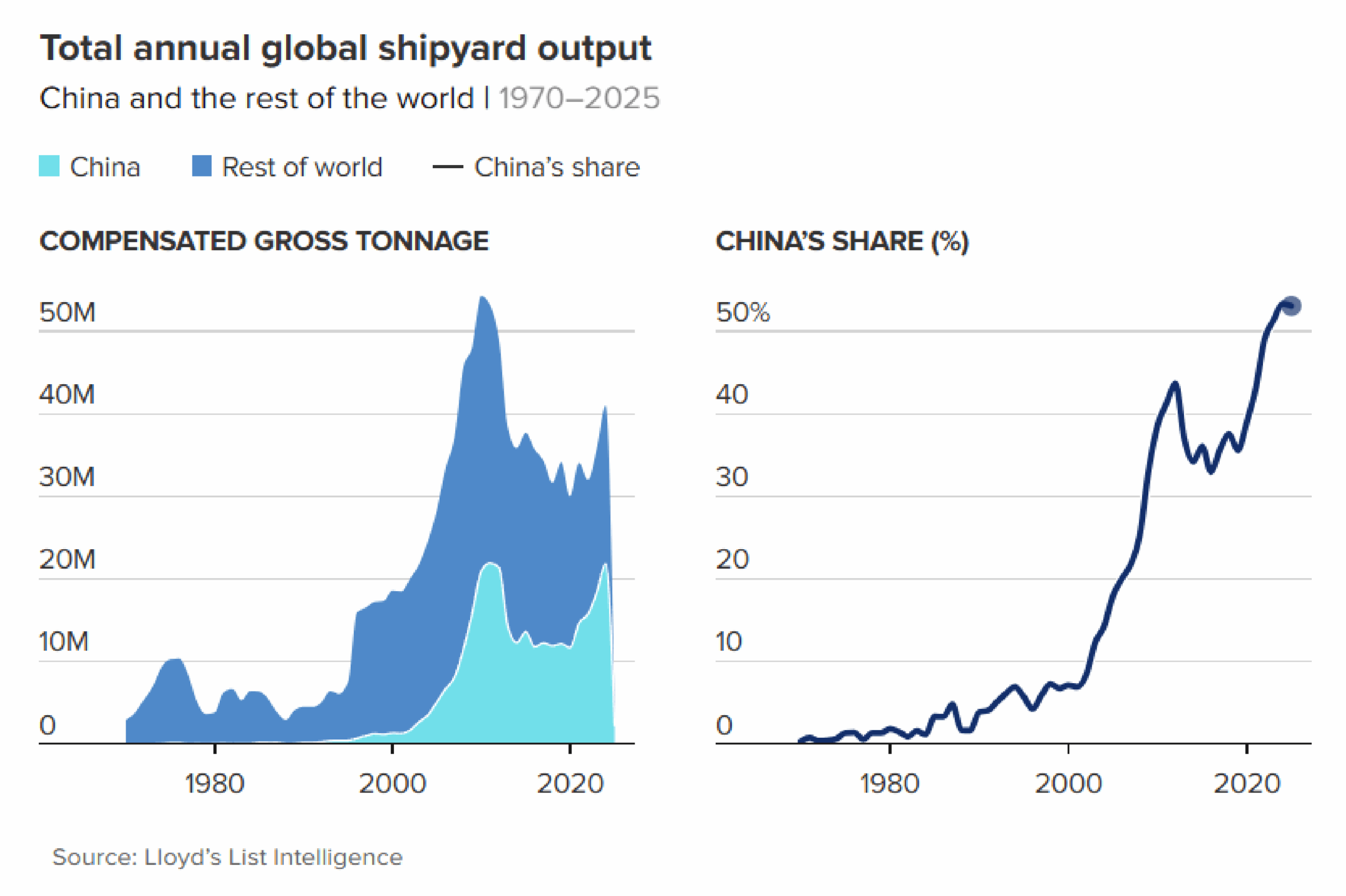

China’s shipbuilding sector benefits from heavy state subsidies and exclusive advantages granted to state-owned enterprises. As a result, China currently controls over 50% of the global shipbuilding market, with tens of billions in public support flowing into the industry.

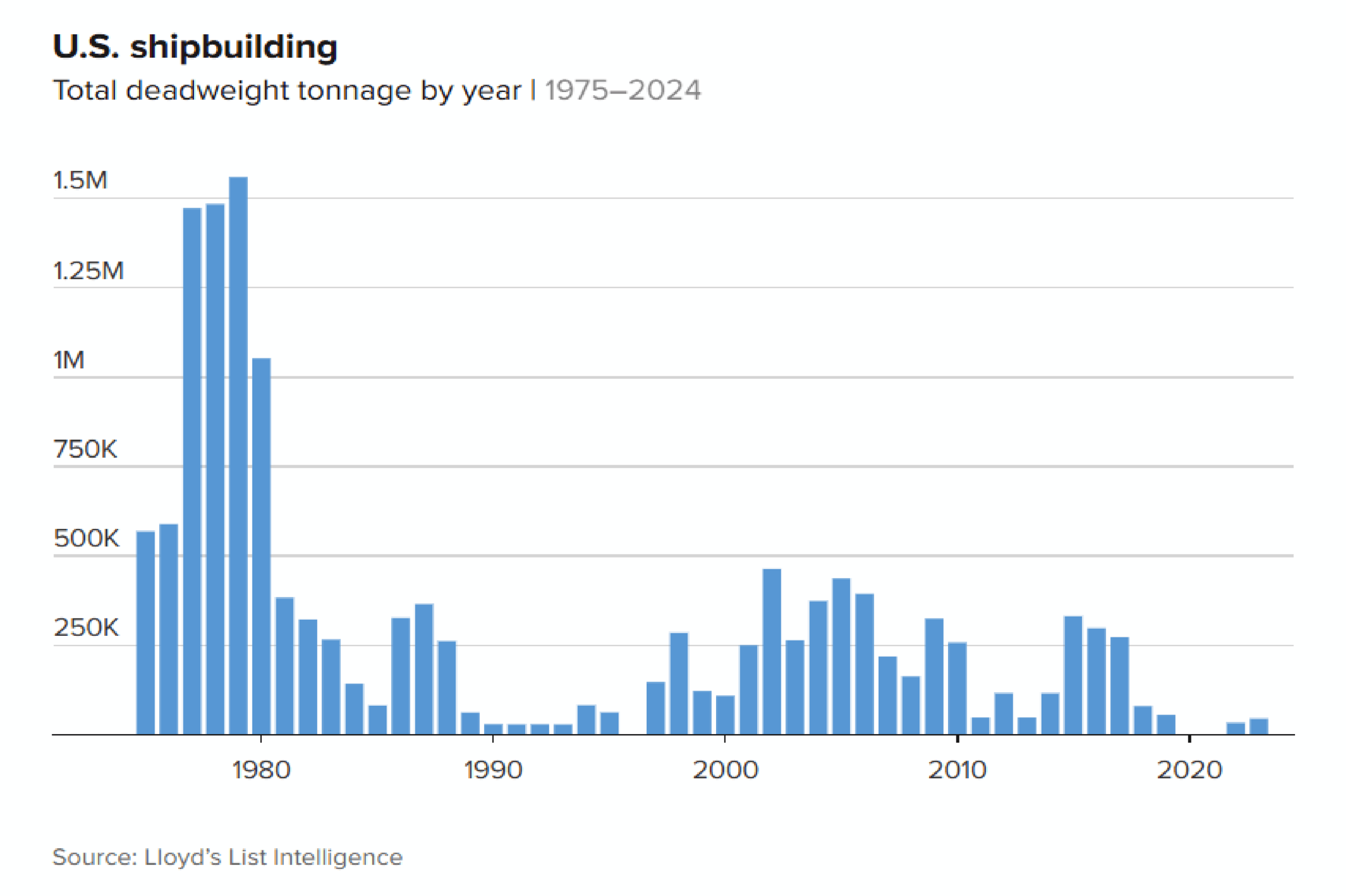

In contrast, the U.S. maritime sector has seen a dramatic decline. In 1975, American shipyards produced over 70 commercial vessels annually. Today, that number has fallen to approximately five ships per year.

USTR Representative Jamieson Greer stated:

“Ships and shipping are vital to American economic security and the free flow of commerce. This policy helps level the playing field and strengthens our supply chain resilience.”

With Chinese-built ships expected to make up 98% of all commercial vessels by 2030, U.S. officials believe now is the time to act.

2. Fee Structure and Timeline

The port fees on Chinese-built ships are scheduled to be rolled out in phases, beginning with zero charges and gradually increasing over the next three years. Here’s how the structure breaks down:

Chinese Vessel Owners and Operators:

| Effective Date | Fee per Net Ton | Approx. Fee per Container |

| April 17, 2025 | $0 | $0 |

| October 14, 2025 | $50 | N/A |

| April 17, 2026 | $80 | N/A |

| April 17, 2027 | $110 | N/A |

| April 17, 2028 | $140 | N/A |

Operators of Chinese-Built Vessels (Container Fees):

| Effective Date | Fee per Net Ton | Approx. Fee per Container |

| April 17, 2025 | $0 | $0 |

| October 14, 2025 | $18 | ~$120 |

| April 17, 2026 | $23 | ~$153 |

| April 17, 2027 | $28 | ~$195 |

| April 17, 2028 | $33 | ~$250 |

These fees will be applied up to five times per year per vessel, depending on voyage frequency. Additionally, car carrier vessels built abroad will face a separate fee starting at $150 per Car Equivalent Unit (CEU) in late 2025.

3. Remission Policy and Exemptions

To incentivize domestic shipbuilding, the policy includes a remission clause. Vessel owners who place orders for U.S.-built ships may be exempted from the port fees, provided the ship is delivered within three years. If the delivery is not completed on time, fees become immediately due.

Fee Exemptions:

- Ships sailing between U.S. mainland and:

- The Caribbean

- U.S. territories

- Great Lakes ports

- The Caribbean

- U.S.-based carriers such as Matson and Seaboard Marine

- Vessels arriving empty to pick up exports

- Bulk exports of commodities such as coal and grain

These exemptions aim to minimize disruptions to key trade routes while protecting strategic domestic industries.

4. Industry Reactions and Concerns

The announcement of port fees on Chinese-built ships has stirred controversy across the global logistics and shipping industries.

The World Shipping Council (WSC) criticized the policy, stating that it could increase the cost per container by $600 to $800, particularly on exports from the U.S. This could double shipping costs for U.S. farmers, manufacturers, and exporters, further burdening industries already facing supply chain volatility.

“This move risks creating economic friction and may lead to retaliatory trade measures,” the WSC warned.

Shippers using chartered Chinese-built vessels — the vast majority of the global fleet — are now evaluating whether they can switch to non-Chinese vessels or absorb the rising costs.

5. Strategic Implications for U.S. Shipping

Despite criticism, the USTR has laid out a long-term strategy to rebuild the U.S. maritime industry. A proposed export reservation system would require a certain percentage of U.S. exports to be shipped on U.S.-flagged vessels over time:

| Implementation Year | Export Reservation Requirement |

| Immediate (2025) | 1% of exports on U.S. vessels |

| Year 2 (2026) | 3% of exports |

| Year 3 (2027) | 5%, including 3% on U.S.-built vessels |

| Year 7 (2031) | 15%, including 5% on U.S.-built vessels |

This strategy aligns with broader national security goals: to ensure that critical trade infrastructure is less dependent on foreign manufacturing — especially from strategic competitors.

6. Conclusion

The imposition of port fees on Chinese-built ships is a bold and strategic policy shift by the U.S. government. While it seeks to correct longstanding trade imbalances and reinvigorate domestic shipbuilding, it also raises questions about the cost to global trade and the risks of escalating maritime tensions.

Businesses in the logistics and shipping sectors must stay informed, analyze cost impacts, and adapt their operations accordingly. As the policy rolls out through 2028 and beyond, its true effects on global supply chains will become increasingly clear.

————————-

Contact us for more information:

Facebook: MN Shipping Co., Ltd – Vietnam

Instagram: mnshippingvn

Hotline: 0936 11 9090

Our related posts: https://mnshipping.com.vn/vietnam-faces-46-tarifff-as-the-us-imposes/