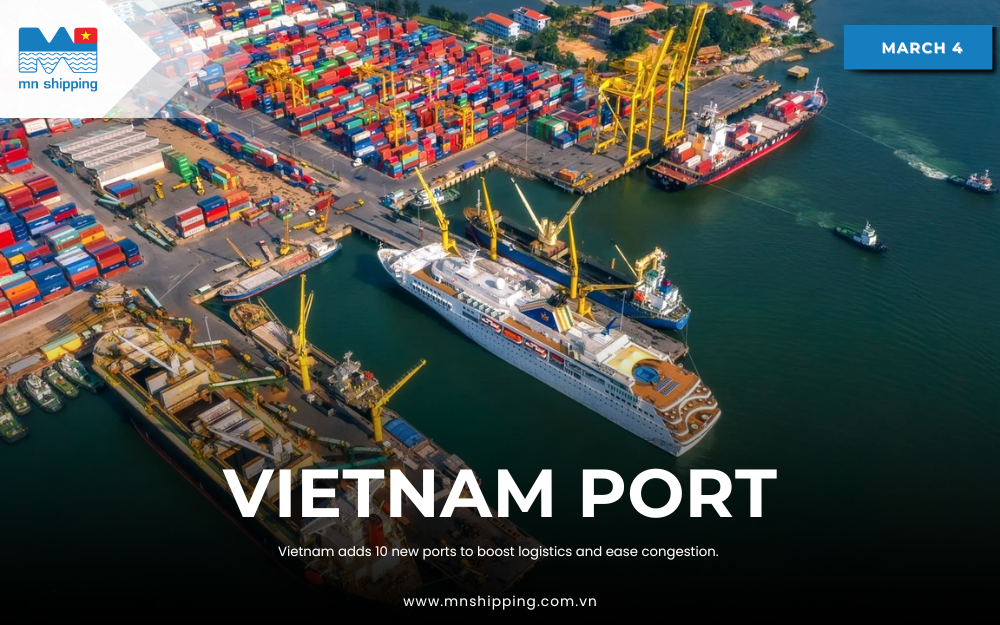

The Vietnam port system plays a crucial role in the development of Vietnam’s logistics sector. With the rapid growth of import-export activities, the Ministry of Transport has decided to add 10 new ports to the national port network. This move not only aims to enhance maritime transport capacity but also presents various opportunities and challenges for local logistics businesses.

Driving Forces Behind Vietnam’s Port Expansion

According to the General Department of Customs, Vietnam’s total import-export turnover reached over USD 700 billion in 2023, showing a significant increase compared to previous years. The growing trend of international trade has led to a rising demand for maritime transportation. However, major ports such as Cat Lai (Ho Chi Minh City) and Hai Phong are operating at over 90% capacity (Vietnam Maritime Administration, 2024), causing congestion and driving up logistics costs.

Therefore, the addition of 10 new vietnam ports aims to ease the burden on key ports, optimize supply chains, and support regional economic development. Among these new ports, some serve as important transshipment hubs, while others specialize in oil and gas, fuel, thermal power, and bulk cargo handling.

Read more: TCIT STRENGTHENS VIETNAM’S ROLE IN GLOBAL TRADE WITH PREMIER ALLIANCE PARTNERSHIP

Impact of Vietnam Port Expansion on the Logistics Industry

1. Increasing Maritime Transport Capacity to Support Trade

Vietnam Port Expansion system significantly improves the country’s maritime transport capacity. According to the Ministry of Transport, the total cargo throughput of Vietnamese ports has exceeded 750 million tons per year, with an average annual growth rate of 6-8%. The new ports will contribute to further increasing this capacity, reducing the load on main shipping routes, and providing better conditions for import-export businesses.

Nguyen Xuan Ky, CEO of Cai Mep International Terminal (CMIT), stated: “Expanding the port network will help Vietnam compete better on the global logistics map, especially as e-commerce and global supply chains are evolving rapidly” (Vietnam Logistics Review, 2024).

2. Reducing Logistics Costs and Optimizing Supply Chains

One of Vietnam’s biggest logistics challenges is its high transportation costs, which account for about 20% of GDP—significantly higher than the global average of 10-12% (World Bank, 2024). Developing additional ports helps shorten transportation distances, reduce reliance on road and rail transport, and ultimately lower logistics costs.

According to a report by the Vietnam Logistics Business Association (VLA), if ports are strategically located and well-connected to domestic transportation networks, logistics costs could decrease by 10-15% over the next five years.

3. Opportunities for Domestic and International Logistics Companies

The increasing number of ports also creates demand for expanded logistics services such as warehousing, inland transportation, customs clearance, and cold supply chains. Local logistics companies will have more opportunities to collaborate with international partners, leveraging competitive advantages in geographical location and labor force.

Additionally, major global logistics corporations such as Maersk, DHL, and Kuehne + Nagel are showing growing interest in the Vietnamese market. Foreign direct investment (FDI) in Vietnam’s logistics sector reached USD 5.6 billion in 2023, reflecting strong international confidence in the country’s port expansion.

Lars Jensen, a maritime transport analyst, commented: “Vietnam is becoming one of the most attractive destinations for logistics investors due to its rapidly expanding port infrastructure” (SeaTrade Maritime News, 2024).

Challenges to Overcome

Despite its advantages, port expansion also presents several challenges. One major issue is infrastructure connectivity. Many new ports are located in provinces where road and rail networks are still underdeveloped, making it difficult to transport goods from ports to inland destinations. To address this, the government needs to invest heavily in highways, railways, and digital logistics systems.

Furthermore, competition among vietnam ports will intensify. Without proper coordination in management, some ports may operate below optimal capacity, leading to resource inefficiencies. Additionally, port infrastructure investments require substantial capital, necessitating private sector participation and foreign investment.

Future Trends in Vietnam’s Logistics Industry After Port Expansion

In the coming years, Vietnam’s logistics industry will focus on key trends:

- Digital Transformation: Integrating Artificial Intelligence (AI) and the Internet of Things (IoT) into port management to optimize operations (Vietnam Digital Logistics Report, 2024).

- Green Logistics Development: Encouraging the use of renewable energy in maritime transportation to reduce CO2 emissions (Green Maritime Transport Initiative, 2024).

- Enhanced Infrastructure Connectivity: Expanding railway and highway systems to improve port access to industrial zones (Vietnam Transport Strategy Report, 2024).

Conclusion

The addition of 10 new ports to Vietnam’s national port network marks a significant milestone in boosting maritime transport capacity, reducing logistics costs, and supporting trade growth. However, to fully capitalize on this expansion, coordinated investments in transportation infrastructure, port management, and technology adoption in logistics are essential.

Logistics companies should seize this opportunity to expand services, optimize supply chains, and strengthen partnerships with international stakeholders. Only with close collaboration between the government, businesses, and investors can Vietnam’s port sector reach its full potential and position the country as a leading logistics hub in the region.

References

- Vietnam Seaport Development – International Trade Administration: Overview of Vietnam’s port expansion plans, aiming to handle 1.25 – 1.5 billion tons of cargo by 2030.

- Vietnam Logistics Market Size & Share Analysis – Mordor Intelligence: Analysis of Vietnam’s logistics market, including growth rates, challenges, and opportunities for businesses in the sector.